Intellectual Property (IP) and the associated rights (IPRs) are a vital source of competitive and sustainable value for the majority of modern organizations. A key step in realizing the value inherent in the many forms of IP that an organization has is the establishment of an expert, informed IP valuation. A robust IP valuation with a transparent methodology allows the business owners to make informed decisions about the direction of the organization in terms of IP creation, management and exploitation. A clear IP valuation also allows business owners to present the value of the organization to potential investor and acquirers.

A diverse range of asset types to identify and manage

IP is often thought of as the protectable rights assigned to particular intellectual assets such as patents and trademarks. However IP potentially includes different types of material such as:

- Patents

- Copyright

- Trade Marks

- Designs

- Trade Secrets

- Database Rights

- All other forms of IP, such as confidential material

It is often the underlying intangible “know-how”, often in peoples’ heads that provides the “magic sauce” in modern organizations.

The value of the IP is highly contextual – estimating the value of patent portfolios is extremely difficult given the contextual nature of patents – the value of patents depends heavily on the nature, commercial model and strategic synergies with the organisation.

For example, if a business needs to defend itself against patent assertion, it may look for patents as counter claims, where the “value” of those assets relate to the direct risk of the original assertion.

Where a business is seeking to build partnerships and joint ventures the benefits derived from corporate know-how and trade secrets may be more valuable.

It is therefore critical to understand the context and purpose of valuation before attempting to model potential $ figures. Further, it is vital that organisations can present this valuation in a concise and digestible manner to stakeholders.

Cubicibuc has significant experience in valuing IP and technology for commercialization

In our experience successful management and exploitation of IP requires a combination of legal, commercial, stakeholder and technical expertise.

- Legal expertise is needed to ensure the IP assets are fit for purpose – ownership is clear, and asset are maintained

- Commercial expertise is needed to ensure that any transaction is executed to fully exploit the value of the underlying IP

- Stakeholder expertise is needed to identify and extract the complete catalogue of IP which may be held in people and not just on paper

- Technical expertise is needed not only to understand the IP, but also its relevance to commercial products and the wider market place in order to qualify its risks, value and status.

Cubicibuc has a unique combination of deep technical knowledge from multiple industries and a strong track record in providing independent advice supporting IP transactions including patent sales, licensing and investment due diligence.

IP valuation approaches

There are a range of valuation techniques for Intellectual Property, in our experience there are three key approaches to IP valuation each of which can be implemented in different ways:

- Cost method – A good ‘anchor’ for negotiations. The Cost Method bases the valuation on historic cost data, indexed to take account of time. Where cost data is not available proxies may be used

- Market method – This is a practical approach based on comparables. Where recent data for similar IP package / patent portfolios exist such comparable values can be compelling

- Income method – Discounted Cash Flow (DCF) of future licensing royalties. This model is typically employed for patent portfolios where strategic fit within operating companies cannot be anticipated, but licensing royalties from a pure-licensing model can be determined

With IP being one of the key areas of growth for companies, transaction activity becomes increasingly dependent on identifying value-adding IP and then importing it.

A typical M&A deal has several points at which IP should be of importance, from initial IP audit to identify acquisition value, through IP packaging to transfer of assets. A clear IP valuation also allows business owners to present the value of the organization to potential investor and acquirers.

Cost Method

The Cost method is used to estimate the substitution or replacement cost.

For example, a software valuation, historical costs for the development could include:

- Direct payroll costs

- An allocation of indirect overhead costs

- Time spent on tasks related to development personnel

- Time spent by non-data processing employees

In the absence of actual historical development cost data, the development costs can be estimated based on either actual or estimated development time. For software development well established methodologies can be deployed to estimate development effort / cost for given code complexity and size.

For pure patent portfolios development costs are typically not available. In these scenarios it is common to build a model based on prosecution costs of the portfolio linked to some multiple to reflect the background R&D effort and indirect costs to the business. The simplified approach is summarised as

- Engineering Time is generally considered to be 5 times patent prosecution cost

- Prosecutions Costs in US vary but $20,000 per patent is considered average for electrical/mechanical patents

- Maintenance Costs – depending on the life and life left of the portfolio these costs can be accounted for

- Uplift for indirect costs (in the region of 20% to 50% depending on sector)

The overall cost can then be calculated as:

( {number of patents * estimated Prosecution Cost per patent} + {Engineering Time} + Maintenance Costs ) * uplift for indirect costs

Market method

The market method is a practical approach which makes use of prices actually paid for comparable assets in the market place. The characteristic of patent portfolios make finding comparables difficult.

Some technologies, typically characterised by short time to market and high churn products, have active IP markets which creates more benchmarking points; other technologies have smaller markets with fewer players and consequently fewer transactions.

The fall in acquisition activity is a complex matter and is driven by a number of factors including the increased rate of patent invalidation through the IPR process in the US and the change in behavior of the licensee community, who are becoming more aggressive in fighting assertion cases against them – having become battle hardened against the Non-Practising Entities (NPEs) looking to extract royalties.

Income method

Estimating the value of patent portfolios is extremely difficult given the contextual nature of patents – the value of patents depends heavily on the nature, commercial model and strategic synergies with the organisation.

However, a useful approach to ascertaining the IP valuation can be taken by considering the potential royalties that may be captured by the portfolio. This future value can then be modelled using an income method. The leading income method approach, the Discounted Cash Flow (DCF) Method is long established and widely used in many finance domains including equity analysis and project finance. The output of the DCF calculation, the ‘Net Present Value’ is a single quantified benefit of an ownership right in an economic opportunity – it expresses the total expected value of all future net cash inflows and, as such, captures the future growth potential of assets (and is not limited value of their inputs – i.e. costs).

This approach is often used by NPEs (Non-Practicing Entities) to establish the price they are willing to pay for a portfolio which they will acquire and then license for financial return. The methodology requires a number of assumptions, and typically takes a “patent counting” approach to comparing patents in the absence of any evidence of infringement / evidence of use of the assets.

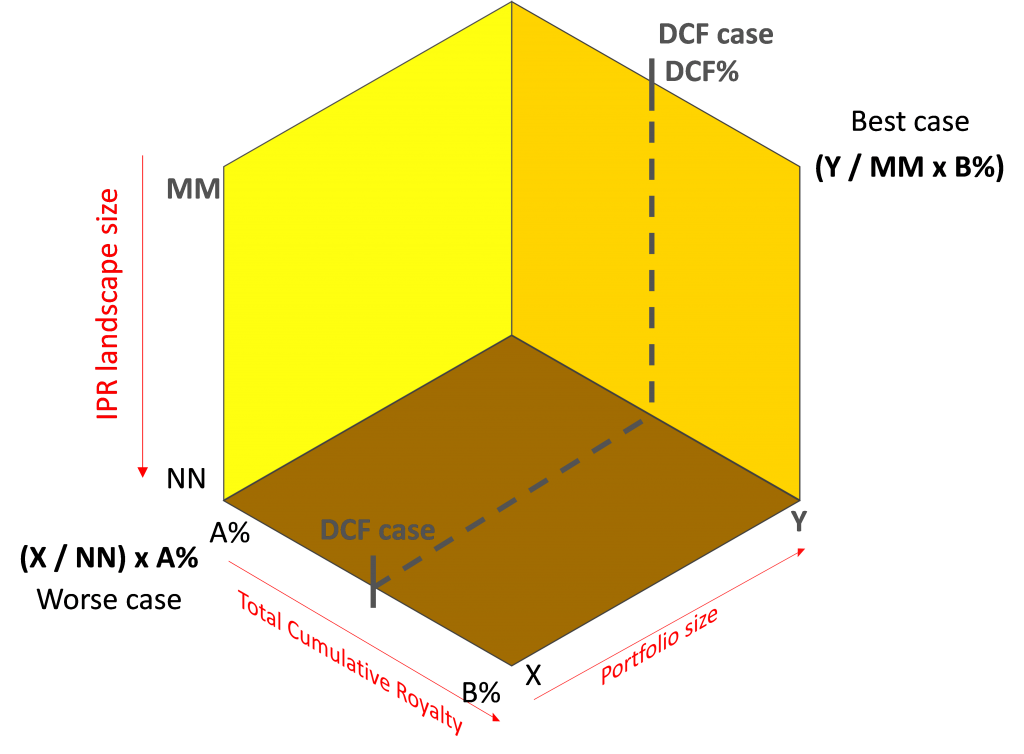

In order to establish the value of IPR under the DCF method, a number of input assumptions typically need to be considered:

- Accessible Market – The total size of the market for the products or services covered by the IPRs – which may be a subset of the global market depending on the geographic coverage of the IP portfolio

- Economic Life – Patents have a life of 20 years, and the “Life Left” is a key driver of portfolio value. In most circumstances buyers of patents do not invest in portfolios with less than 5 years life left as this does not allow for the assets to be fully exploited

- EBIT Margin –The assumed operating profit margin of accessible market

- ‘Rule of Thumb’ – IPR practitioners have long user a rule of thumb as the basis of the share of the operating profit that should go to the licensor – this is often referred to as the Total Cumulative Royalty (TCR) rate for the products or services and depends on the technology and sector

- Apportionment Rate – When there are multiple IPRs infringed or employed in a product or service some level of proportionality is applied to determine a reasonable rate for those IPRs in question – typically by looking at the proportion of the overall landscape of patents

- Discount rate – a rate reflecting the perceived risk of the cashflows

Combining the Accessible Market, EBIT margin, Total Cumulative Royalty and the Apportionment Rate provides the royalty rate applicable for the IPR portfolio in question.

The income method is particularly suited to sensitivity analysis as the key input parameters can be adjusted to provide an overall IP valuation range. Sensitivity analysis involves building a set of possible scenarios and in doing so has the additional benefit of providing a mechanism to capture and evaluate risk. Where stakeholders are sceptical about placing a reliable value on intellectual property the income method can reflect this risk by, for example, varying the discount rate or by probability weighting cash flows.

However, in determining a useful IP valuation it is often appropriate to combine two or more methods. Being able to combine IP valuation approaches to reinforce a valuation range can be a critical to negotiation success.

Download or get in touch

We believe good IP management allows business to protect its competitive advantage; to generate returns on R&D investment and to secure investment and finance. Modern businesses neglect their IP assets at their risk as poor IP management gives away value and reduces barriers to entry for competitors compromising the organisation’s capabilities.

To manage IP well business must adopt a combination of commercial, legal and technical expertise – but always with a pragmatic focus to actively manage and exploit the IP.

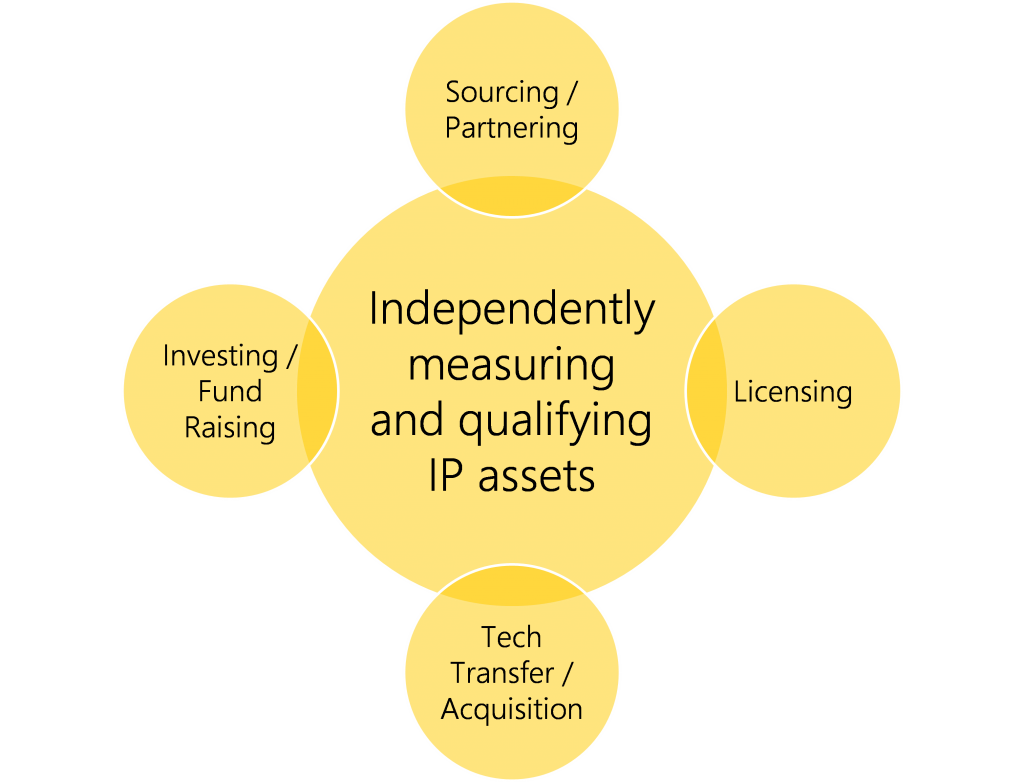

Cubicibuc supports its clients by:

- providing confidential and independent technical services to evaluate IP assets

- performing IP audits, patent mining and landscaping exercises

- developing IP strategies to support commercial negotiation, licensing and litigations

- providing independent technical expert reports

We work with businesses ranging from smaller start-ups to mature multinationals; from early stage invention capture through to exploitation and monetisation of IP assets.

To discuss how Cubicibuc’s expertise can help your organisation manage and exploit IP, please contact us now.