Managing IP Risks

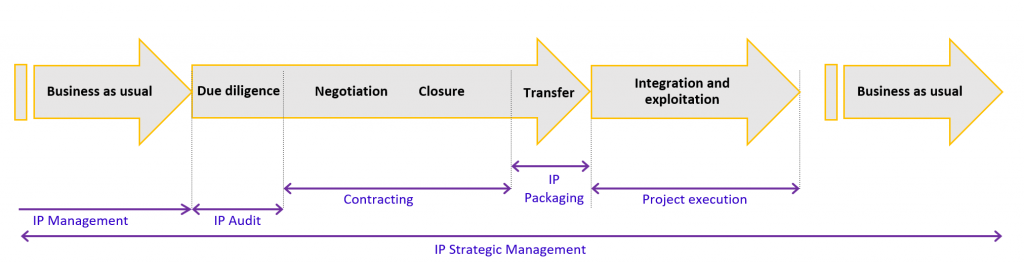

While it is common to hear that a large part of an organization’s value is associated with its IP, it is uncommon to see much effort spent on actually reviewing that IP during the due diligence phase of M&A or tech transfer activities. Typical commercial contracts rely on post-transaction remedies in the form of reps and warranties. In the extreme a failure to sufficiently inspect the IP ahead of closure may mean failure of the transaction.

In the case of later uncertainty over the contents of the IP package expensive post-transaction project-recovery is likely.

Cubicibuc believes that a better approach is to take the time to review the package of IP (patents, know-how, design documents, manufacturing instructions etc) ahead of the transaction itself to ensure all the necessary components are present, and that the total package fits with the identified gap in the organisation’s IP strategy.

Managing the risks of IP transfer during transactions

In the absence of a pragmatic, technically driven IP due diligence process, gaps in the IP package typically lead to costly project-recovery exercises which add costs to the process and delay any potential integration.

When an organisation considers importing IP from any source, and by any means – licensing, acquisition or partnership – the importing organisation must be sure that all necessary and sufficient IP elements are present.

It is vital that an independent check of the kit of parts is performed. All component, instructions and know-how for the intended use need to be reviewed and independently verified.

Cubicibuc – IP Assurance

IP Assurance, as it is sometimes known, allows both seller and buyer to benefit from an independent review of the package of IP.

For a seller / IP owner such an analysis ensures the right package of IP is transfers – to reduce the risk of future claims – but only the necessary IP, nothing more. A seller may also be able to demonstrate the value of the IP when it is packages well.

For a buyer the risk of acquiring IP with missing components is reduced, hence allowing the buyers ability to integrate the solutions more quickly. The buyer also has the comfort that the IP has been independently verified.

“The success or failure of an acquisition lies in the nuts and bolts of integration. To foresee how integration will play out, we must be able to describe exactly what we are buying”

(Harvard Business Review – March 2011).